The automotive world is currently obsessed with electrification, but Toyota is taking a firm stand: achieving global decarbonization requires more than just Battery Electric Vehicles (BEVs). The company is placing a massive strategic bet on Fuel Cell Electric Vehicles (FCEVs) and hydrogen fuel cell technology, viewing it as a necessary complement to BEVs and hybrids.

The strategic shift towards hydrogen mobility

While the Toyota Mirai, its sleek sedan and flagship hydrogen car, served as a crucial consumer test platform, Toyota’s strategy has pivoted decisively. The focus is no longer competing for passenger car market share, but on transforming into a foundational hydrogen technology provider aimed at the heavy-duty and industrial sectors, logistics, rail, and stationary power. In these sectors, hydrogen’s inherent advantages in energy density and refueling speed are critical for achieving true zero-emission vehicle mobility.

Why Toyota backs hydrogen FCEVs for high-demand logistics

Toyota’s pivot is driven by the industry’s consensus that hydrogen excels precisely where BEVs are fundamentally limited, solving critical operational problems that compromise profitability in large-scale logistics and fleet operations.

| Advantage | Commercial Requirement | Hydrogen Solution |

| Uptime is King | Fleets require maximum continuous operational time. | Refueling a hydrogen truck takes minutes (3-5 min), avoiding the hours of lost revenue incurred while charging massive BEV batteries. |

| Weight Savings | Heavy transport must maximize payload capacity. | For semi-trucks, the battery mass required for long-haul routes is prohibitive. FCEVs offer a much lighter system, preserving cargo capacity and efficiency. |

| Refueling Corridors | Infrastructure must be reliable and concentrated. | Commercial vehicles operate along predictable, high-volume routes, allowing hydrogen refueling stations to be strategically deployed exactly where needed. |

The uphill battle: Why FCEVs lost the consumer war

The pivot is a direct acknowledgement that the FCEV consumer segment is being “completely overshadowed by fully electric vehicles,” due to persistent challenges in infrastructure and efficiency.

Infrastructure scarcity and market disparity

The lack of established refueling infrastructure is the single biggest barrier. Globally, there are only about 1,100 to 1,400 operational hydrogen refueling stations (HRS), with the infrastructure highly concentrated in just a few regions:

- Asia-Pacific Dominance: This region holds the vast majority of stations, led by China (~380 stations), South Korea (~200 stations), and Japan (~160 stations). These countries, driven by strong government mandates, account for nearly two-thirds of the world’s network.

- European Concentration: Europe has about 186 HRS, with the network heavily concentrated in Germany (~110 stations) and France.

- North America: Remains sparse, with the U.S. network largely confined to ~70 stations in California, with no realistic path toward immediate nationwide rollout.

| Fuel Type | Infrastructure Type | Approximate Global Count | Implication of Scale |

|---|---|---|---|

| ICE | Gas/Diesel Stations | ~ 3.5 million gas stations | The established universal benchmark. |

| EV (BEV) | Public Charging Points | ~2.7 million charging points | Massive growth, rapidly forming reliable networks in key markets. |

| Hydrogen (FCEV) | Hydrogen Refueling Stations (HRS) | ~ 1,160 refueling stations | Limited to ~0.03% of the ICE network, restricting FCEVs to niche applications. |

The Toyota Mirai: An amazing vehicle

The Toyota Mirai remains the most visible expression of Toyota’s hydrogen fuel cell expertise, delivering zero tailpipe emissions, a near-silent ride, 640 km (402 miles) of range, and 3–5 minute refueling. Yet as global FCEV adoption remains limited, Toyota is recalibrating its strategy.

First and second generations: Building the future

First launched in 2014 as one of the world’s first mass-produced Fuel Cell Electric Vehicles (FCEVs), the Mirai, Japanese for “future”, represented Toyota’s most ambitious effort to move hydrogen mobility from concept to reality.

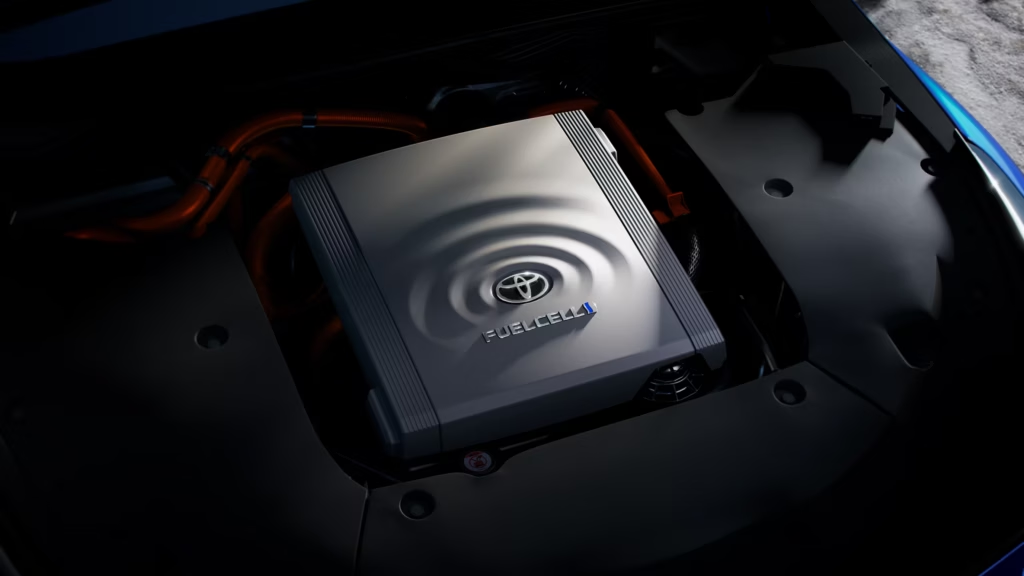

The second-generation Mirai (2021) refined that vision with a rear-wheel-drive platform, improved weight distribution, and a sleek, aerodynamic silhouette that elevated it from eco-experiment to elegant, zero-emission luxury sedan. Its fuel cell stack acts as a self-contained power plant, combining hydrogen and oxygen to generate electricity while emitting only water vapor.

Toyota Mirai third generation: Improvements everywhere!

Beneath its design, engineers integrated a three-tank hydrogen system pressurized to 700 bar (10,000 psi) for safety and range, paired with Toyota’s Hybrid Synergy Drive components for smooth, instant acceleration. The result is a polished, refined EV experience that showcases hydrogen’s technical maturity, even as infrastructure and market realities temper its global expansion.

The 2025 Mirai in Europe: A technology flagship

In Europe, the Mirai remains available in select markets such as Germany, the UK, the Netherlands, and Scandinavia, primarily through fleet programs and pilot projects like H2 Moves Berlin. The 2024 European model, continuing into 2025, benefits from Toyota Safety Sense 3.0, a Panoramic View Monitor, and premium trim options such as Executive and Prestige grades. Sales, however, remain modest, 533 units across Europe in 2024, reflecting the region’s limited refueling network and Toyota’s focus on fleet-based, infrastructure-driven deployments rather than retail volume.

Ultimately, the 2025 Mirai marks not an end but a strategic realignment. It continues as a rolling R&D platform for Toyota’s third-generation fuel cell system, technology that promises lower cost, higher efficiency, and improved durability. The knowledge gained from nearly a decade of Mirai development is now steering Toyota’s broader hydrogen strategy, powering commercial trucks, buses, and industrial applications that could finally scale hydrogen mobility beyond the passenger car segment.

Inside Toyota’s 3rd Gen hydrogen fuel cell system

The future viability of this technology rests entirely on the 3rd Generation FC System, planned for deployment after 2026. This system is engineered for industrial scalability and cost parity with diesel engines.

| Metric | Estimated 3rd Gen FC Performance (Target) | Improvement vs. 2nd Gen | Strategic Impact on Cost of Ownership |

| System Cost | ~$50/kW | Up to 50% Reduction | Achieves cost parity with diesel engine manufacturing by reducing expensive components like Platinum (Pt) Loading. |

| Durability / Lifespan | Up to 2X Increase (Comparable to diesel) | 2X Increase | Meets the longevity and uptime requirements of commercial diesel engines (eg, ~ 6,000 operating hours). |

| Power Density | ~3.7-4.0kW/L | 20% Increase | Achieved through System Simplification (the crucial Humidifier Elimination), enabling lighter, more space-efficient industrial integration. |

The core of this technology is the Fuel Cell Stack, which converts hydrogen and oxygen into electricity. Unlike a BEV, which stores energy, the FCEV generates electricity on demand, with the only emission being water vapor.

The strategic landscape: Competition and ecosystem building

Toyota’s push into the commercial sector is part of a global, multi-faceted strategy defined by competition and the absolute necessity of partnerships to build the foundational hydrogen economy.

Competition and Collaboration

- Commercial Sector Competition: The race for zero-emission logistics is fierce, with Daimler Truck, Volvo, and Nikola all prioritizing hydrogen-powered semi-trucks, signaling a collective industry shift.

- Encouraging Rivals: Toyota actively welcomes the involvement of rivals like Hyundai (Nexo) and BMW (iX5 Hydrogen pilot fleet) because their participation expands the hydrogen ecosystem, forcing investment in refueling networks.

Toyota’s Strategic Infrastructure Investments

Toyota recognizes that it must be an active hydrogen infrastructure builder, targeting areas of guaranteed commercial demand:

- Sustainable Production: The company is collaborating with the Chiyoda Corporation to develop and manufacture a water electrolysis system for low-carbon hydrogen production in Japan. The Tri-Gen facility at the Port of Long Beach converts renewable biogas into hydrogen, electricity, and water, creating a reliable, closed-loop sustainable fuel source.

- Global Investment: Toyota committed $139 million to a joint venture in Chengdu, China, explicitly to accelerate mass production and market penetration for its FC stacks.

- Refueling Technology: Backing technologies like the Twin Mid Flow Technology in Europe, which reduces station cost and complexity by rapidly servicing both light- and heavy-duty vehicles.

The future of Toyota’s hydrogen vehicles: The commercial pivot

Toyota’s hydrogen car plans are almost exclusively commercial. The modular 3rd Generation FC System provides the core technology for hydrogen-powered transportation in new categories:

- Commercial Trucks: Offering zero-emission solutions that match the payload and range of diesel rigs, capable of refueling for 600km in under 8 minutes.

- Buses and Rail: Replacing polluting diesel locomotives and city bus fleets.

- Stationary Power: Serving as large-scale, 1-Megawatt power generators for industrial campuses and data centers.

This push aligns with Toyota’s Environmental Challenge 2050 goal, ensuring that the hydrogen used is green hydrogen (produced via electrolysis powered by clean energy) to achieve true life-cycle carbon-neutral mobility. By making the technology radically cheaper and more durable, Toyota is ensuring its place as a key enabler of automotive innovation.

Conclusion: A bridge to the next mobility era

Toyota’s commitment to hydrogen technology is a strategic masterstroke built on technological advantage and commercial necessity. The Toyota Mirai provided the foundation, but the commercial pivot, driven by the aggressively optimized 3rd Gen FC System and its $50/kW cost target, is where the hydrogen economy will achieve critical scale.

FCEVs offer unparalleled advantages in power density, weight, and refueling speed, qualities that are non-negotiable for industrial operations. While the technology is mature, its potential remains constrained by the current infrastructure. By building that infrastructure from the top down through strategic partnerships and targeted investment, Toyota ensures that its Toyota hydrogen engine technology will be ready to power a diverse and robust carbon-neutral future.